For most people, their home is their biggest investment — and their biggest tax benefits. As always, it’s best to consult your tax adviser for specific information, but let’s walk through the most common, basic tax savings of homeownership.

Income Tax Savings

When you file your federal income taxes each year, you are allowed to deduct certain expenses from your taxable income. The IRS offers taxpayers a standard deduction which they can subtract off of their income. The Tax Reform Act of 2017 increases the standard deduction from $6,500 per single filer and $13,000 for married filing jointly to $12,000 and $24,000 respectively. That’s a significant increase and means that for some filers who itemize deductions it may make more sense to just claim the standard deduction beginning in the 2018 tax year.

Itemized deductions include home mortgage interest paid, property taxes, state income taxes, state and local sales taxes, charitable giving, medical and business expenses subject to threshold amounts. There are some new caps on these that can affect how much is deductible. If you have enough qualifying deductions that exceed the standard deduction, you are better off passing on the standard and claiming your own. This is known as “itemizing.”

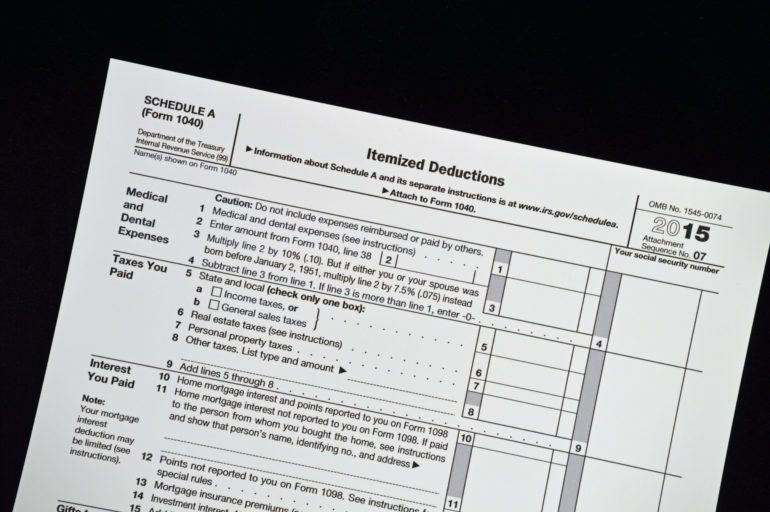

Itemizing deductions is done by filing your taxes on Form 1040 and the deductions are listed on Schedule A. Here’s what homeownership allows you to claim.

Interest and Points

One of the most important tax deductions for homeowners is interest paid on their mortgages each year. As you make your monthly payment, a portion of it goes toward the interest charged on the loan. At the end of the year, the total interest paid is deductible from your taxes. However, the Tax Reform Act of 2017 lowers the maximum mortgage debt from $1 million to $750,000 for which interest is deductible. The original $1 million cap will remain in effect for homes purchased before December 15, 2017 only.

Deductability also applies to “discount points” paid to buy down the mortgage interest rate upon purchase of the house. Discount points are prepaid interest and are deductible as long as you meet certain requirements. If the points are paid on a home improvement loan or mortgage for a second home, they are deductible, but under different rules.

Origination fees, paid when taking out a mortgage, and figured as points of the loan amount, are tax deductible if they are a charged by the lender to acquire the mortgage and not to cover sundry other fees that normally would be broken out separately on the closing settlement statement.

Property Tax Benefits

You are allowed to deduct property taxes charged by your local taxing authority from your federal income taxes. Typically these are assessed to you by the county government where your home is located. These are local taxes used to benefit the general public for things like public schools and hospitals, county emergency services and infrastructure.

One significant change for 2018 is the total amount of property taxes, state and local sales taxes and state income taxes that are allowed to be claimed are now capped at $10,000 combined. This change could move many taxpayers to the standard deduction.

Mortgage Insurance Premiums

If you buy a home and finance greater than 80% of the value of the home, the mortgage company will require you to pay monthly mortgage insurance premiums protecting it in the event you default. Also known as Private Mortgage Insurance (PMI), these payments are deductible if paid under the IRS definition of qualified mortgage insurance.

Capital Gains Tax Benefits

If you sell your house for a profit you will have received a capital gain, the difference between your cost basis in the home subtracted from the price at which you sold. Your cost basis is the price you paid for the house upon purchase plus any capital expenditures toward improvements, such as remodels.

If you meet certain criteria, you may not owe any taxes on it. The main rule is that you must have lived in the house for at least two of the last five years. A single person under that condition pays no tax on up to $250,000 in gain, and a married couple on up to $500,000. If you don’t meet the two-year residency rule and sell, you will pay a capital gains tax figured on a schedule set by the IRS. There are some other qualifying conditions that affect capital gains taxes, so have your situation evaluated by a tax professional.

Since the interest and property tax deductions added together often exceed the IRS standard deduction, it benefits you as a taxpayer to itemize and claim them. It also paves the way to add other qualifying deductions such as charitable giving and sales taxes paid for the year.

Related – What You Need to Know About Points and Origination Fees